Acquiring New Customers Is More Expensive Than Retaining Existing Ones

The statement acquiring new customers is more expensive than retaining existing ones is a fundamental principle in business and marketing. It’s often cited as a rule of thumb, with some sources suggesting that acquiring a new customer can be anywhere from 5 to 25 times more expensive than keeping an existing one.

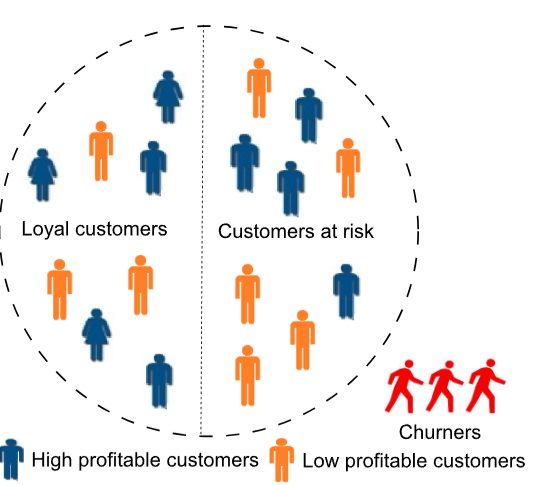

Customer churn can be divided into two categories: intentional and involuntary. Intentional churn occurs when customers voluntarily discontinue using a service because of dissatisfaction or a change in circumstances. They may switch to another provider that offers alternate plans, better service quality, or both. To retain customers, businesses can address the issue by offering attractive plans and ensuring high-quality service. Acquiring New Customers Is More Expensive Than Retaining Existing Ones.

On the other hand, involuntary churn happens when the business stops providing service due to

unpaid bills or breaches of terms and conditions.

There are two sub-categories within intentional churn: deliberate and incidental churn.

- Deliberate churn occurs when customers switch to another provider due to dissatisfaction with the product or service to obtain a better alternative. This dissatisfaction may stem from technical issues such as poor service quality, outdated services, bad customer service experience, poor coverage, or financial concerns such as expensive plans.

- On the other hand, incidental churn happens when customers stop using the service due to changes in their circumstances, such as relocating to another city where the service is unavailable, switching to another job that limits their use of a specific service provider, or the services becoming unaffordable for the customer.

Acquiring New Customers Is More Expensive Than Retaining Existing Ones. The primary goal of churn prediction is to anticipate deliberate churn since involuntary customers who breach (breake) terms and conditions or fail to pay bills are already known to the business. Incidental churn accounts for a small portion of churn, and it is difficult to predict since even the customers themselves may not foresee changes such as a change of place or job before a specific change in reality. Acquiring New Customers Is More Expensive Than Retaining Existing Ones.

Additionally, knowing incidental churn in advance is of little value since retaining those customers becomes unavoidable due to reasons beyond the products and services offered by the business.

(Manzoor, A., Qureshi, M. A., Kidney, E., & Longo, L. (2024). A review on machine learning methods for customer churn prediction and recommendations for business practitioners. IEEE access, 12, 70434-70463.)

Acquiring New Customers Is More Expensive Than Retaining Existing Ones. Read about Customer Retention Survival Analysis

Cost of Marketing and Sales

- Acquisition: To attract a new customer, businesses must invest heavily in marketing and advertising. This includes a wide range of activities, from digital advertising campaigns (PPC, social media ads) and content marketing to traditional methods like TV and print ads. They also have to pay sales teams to find, nurture, and close leads. These costs can be substantial and add up quickly. Acquiring New Customers Is More Expensive Than Retaining Existing Ones.

- Retention: Your customers are already familiar with your brand and main product offer, so you don’t need to spend so much money on broad-reach advertising. But still you spend this money for acquiring a new customers. Retention efforts typically involve more targeted and cost-effective strategies, such as email marketing, loyalty programs, and personalized communications. Loyalty program usually cost you the same, if not more, as acquiring new customers. What really matters – customers you already have in database they are more likely to buy from you then others, but you have to pay them for that. Acquiring New Customers Is More Expensive Than Retaining Existing Ones

Trust and Familiarity

- Acquisition: New customers have no prior relationship with your business. They need to be convinced to trust you and choose your product or service over competitors. The sales process for a new customer can be lengthy and resource-intensive as you build that trust. The probability of selling to a new prospect is much lower (often cited as 5-20%) compared to an existing customer. Acquiring New Customers Is More Expensive Than Retaining Existing Ones

- Retention: Existing customers have already purchased from you and, ideally, had a positive experience. You have teach them already your organisation and your products. But that was an investment in your customers – that cost you money. They have built trust in your brand. This makes them more receptive to your messages and offers. The probability of selling to an existing customer is much higher (often 60-70%).

Customer Lifetime Value (CLV)

- Acquisition: A new customer’s first purchase may not be enough to cover the initial acquisition cost. The business needs that customer to make repeat purchases to become profitable. If a customer “churns” (leaves) quickly, the business may have lost money on that acquisition. Acquiring New Customers Is More Expensive Than Retaining Existing Ones

- Retention: Loyal, retained customers tend to have a higher Customer Lifetime Value (CLV). They are more likely to make repeat purchases, spend more per transaction, and try new products or services. This means that the revenue generated from them over time far outweighs the minimal cost of maintaining the relationship. Acquiring New Customers Is More Expensive Than Retaining Existing Ones

Word-of-Mouth Marketing

- Acquisition: You have to actively seek out and find new customers. This is a proactive and expensive process. Acquiring New Customers Is More Expensive Than Retaining Existing Ones

- Retention: Happy and loyal customers can become brand advocates. They are more likely to recommend your business to friends, family, and colleagues. This organic, word-of-mouth marketing is not only highly credible but also essentially free, leading to new customer acquisition at a fraction of the cost.

The Importance of Balance

While the statement highlights the cost-effectiveness of retention, it’s crucial to understand that both acquisition and retention are essential for a healthy business. Acquisition is necessary for growth and market expansion, while retention ensures long-term profitability and stability. The key is to find the right balance, making sure that your customer acquisition efforts are bringing in valuable customers who will stay long enough to become profitable and contribute to the business’s long-term success. Acquiring New Customers Is More Expensive Than Retaining Existing Ones.

Acquiring New Customers Is More Expensive Than Retaining Existing Ones. You’ve asked a great question that gets to the heart of the matter. While the concept seems simple, the calculation requires breaking down the costs that are often lumped together. Let’s walk through a clear, hypothetical example for a fictional company called “Daily Dose Coffee,” a subscription service for gourmet coffee beans. Acquiring New Customers Is More Expensive Than Retaining Existing Ones.

Acquiring New Customers Is More Expensive Than Retaining Existing Ones – calculations

The Scenario

Company: Daily Dose Coffee, Time Period: One month

The marketing and sales teams want to know the cost difference between acquiring a new customer and retaining an existing one.

Part 1: Calculating Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the total amount of money a company spends to acquire a single new customer. Acquiring New Customers Is More Expensive Than Retaining Existing Ones.

The Formula:

CAC=Number of New Customers Acquired / Total Acquisition Costs

Step 1: Identify all acquisition costs for the month.

- Advertising:

- Google Ads: $5,000

- Social Media Ads (Facebook, Instagram): $3,000

- Marketing & Sales Salaries:

- Salary for the marketing manager: $4,000 (They spend 100% of their time on acquisition.)

- Portion of sales team salaries dedicated to finding new leads: $2,500

- Tools & Software:

- CRM software (for new leads): $500

- Email marketing tool (for new subscribers): $200

- Promotional Offers:

- Cost of “First month free” promotion: $1,000

Step 2: Sum the total acquisition costs.

Total Acquisition Costs = $5,000 + $3,000 + $4,000 + $2,500 + $500 + $200 + $1,000 = $16,200

Step 3: Determine the number of new customers acquired in that month.

In this month, Daily Dose Coffee successfully converted 200 new subscribers.

Step 4: Apply the CAC formula.

CAC=200 new customers$16,200=$81.00

Conclusion: It cost Daily Dose Coffee an average of $81.00 to acquire each new customer this month.

Part 2: Calculating Customer Retention Cost (CRC)

Customer Retention Cost (CRC) is the total amount of money a company spends to retain its existing customers.2 This is often more complex as costs can be harder to isolate.

The Formula:

CRC=Number of Retained Customers / Total Retention Costs

Step 1: Identify all retention costs for the month.

- Customer Support:

- Salary for the customer support team: $3,000 (They handle all existing customer inquiries.)

- Cost of live chat software: $150

- Loyalty & Engagement Programs:

- Cost of the loyalty program (points, rewards): $800

- Email marketing tool (for existing customers): $200

- Promotional Offers:

- Special “Thank You” discount for loyal customers: $500

- Operational Costs to Maintain Service:

- Cost of subscription management software: $300

Step 2: Sum the total retention costs.

Total Retention Costs = $3,000 + $150 + $800 + $200 + $500 + $300 = $4,950

Step 3: Determine the number of customers retained in that month.

Daily Dose Coffee started the month with 1,500 customers and ended with 1,450. Since they acquired 200 new customers, this means they lost 250 from their original base (1500 – 1450 = 50 lost, plus 200 new = 250 lost).

In this context, the number of retained customers is the number of customers who did not churn.3

Number of Retained Customers: 1,500 (beginning) – 50 (lost) = 1,450.

Note: Some businesses calculate CRC based on their entire active customer base for the period (1,450 retained + 200 new = 1,650), but for a direct comparison with acquisition cost, focusing on the customers you successfully kept is often a clearer metric. Let’s use the number of retained customers (1,450).

Step 4: Apply the CRC formula.

CRC=1,450 retained customers$4,950=$3.41

Conclusion: It cost Daily Dose Coffee an average of $3.41 to retain each existing customer this month.

Final Comparison

- Cost to acquire a new customer (CAC): $81.00

- Cost to retain an existing customer (CRC): $3.41

As you can see from this example, the cost of acquisition is dramatically higher than the cost of retention.4 This isn’t a fluke; it’s a common trend across most industries. Acquiring New Customers Is More Expensive Than Retaining Existing Ones.

This simple calculation shows why focusing on customer loyalty and satisfaction is so critical for long-term profitability. By keeping a customer, you’re not just securing their future purchases; you’re also avoiding the much higher cost of having to replace them with a new customer.